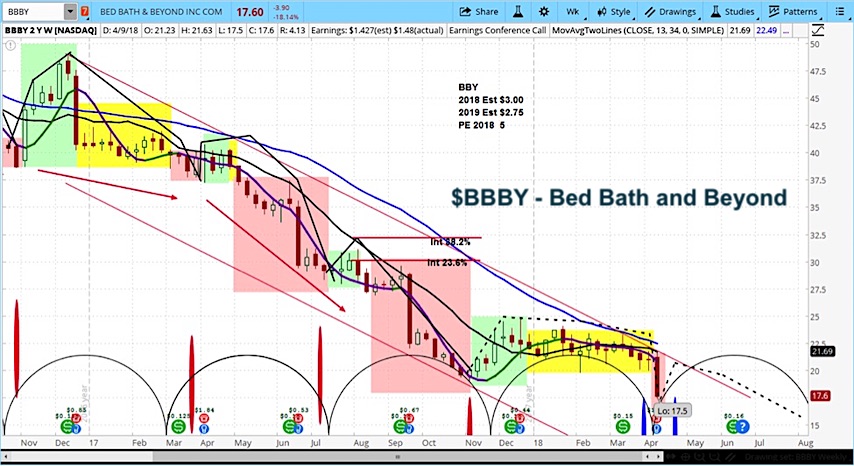

Bed Bath & Beyond – Technical outlookīed Bath & Beyond stock price is continuously in a downtrend and traders seem to be aggressively building shorts positions on every rise. Moreover, On FebruBBBY price again witnessed wild short covering which usually ended up as a bull trap and BBBY prices again back to the ground. Later, the short covering continued for some more time and prices rose by 331% within a week which is quite surprising as well as shocking. In the beginning of January, BBBY stock price hit a 52 week low at $1.27 but the next day something magical happened and prices surged 23% which was the initial signs of the short squeeze.

Bed Bath & Beyond share price is dying?īed Bath & Beyond (NASDAQ: BBBY) share price is down 35% on YTD basis and 93% on the yearly basis shows that BBBY is near to bankruptcy and has turned out to be a most speculative stock for the retailers. However, if we look at the BBBY share price it is clear that market capitalization of NASDAQ: BBBY has slipped below $225 million and Hudson Bay will struggle to recover its investment.īed Bath & Beyond Inc current market capitalization is $174.09 million and Hudson Bay deal is $225 million which clearly shows that if BBBY business does not recover or prices did not perform then investment firm Hudson Bay might face difficulty in offloading the BBBY shares. The firm also promised an additional investment of $800 million over time assuming certain conditions are met. In February 2023, news circulated in the market that investment firm Hudson Bay had agreed to pump $225 million into the Home goods retailer BBBY. 3 BBBY share price witnessed a short squeeze in February after injecting $225 million in the company.īed Bath & Beyond (NASDAQ: BBBY) stock price fell below the $2.00 and lost all the previous gains derived by the hype of the $225 million deal.2 Bed Bath & Beyond (NASDAQ: BBBY) has raised $225 million from the Hudson Bay and next round is for $800 million.1 Bed Bath & Beyond (BBBY) Stock price fell below $2.00 and lost all the previous monthly gains.

0 kommentar(er)

0 kommentar(er)